Starting a Bookkeeping Business? Here’s Everything You Need to Know.

If you’re looking to break free from the traditional 9-to-5 grind and gain control over your career, starting a bookkeeping business could be the perfect move. The desire for independence and the flexibility to set your own schedule are powerful motivators for many new entrepreneurs. By launching a bookkeeping business, you can not only enjoy the freedom of being your own boss but also help small businesses thrive by managing their finances. It’s a rewarding path that allows you to turn your skills with numbers into a stable and scalable business, all while having control over your schedule.

Here are the advantages of starting a bookkeeping business:

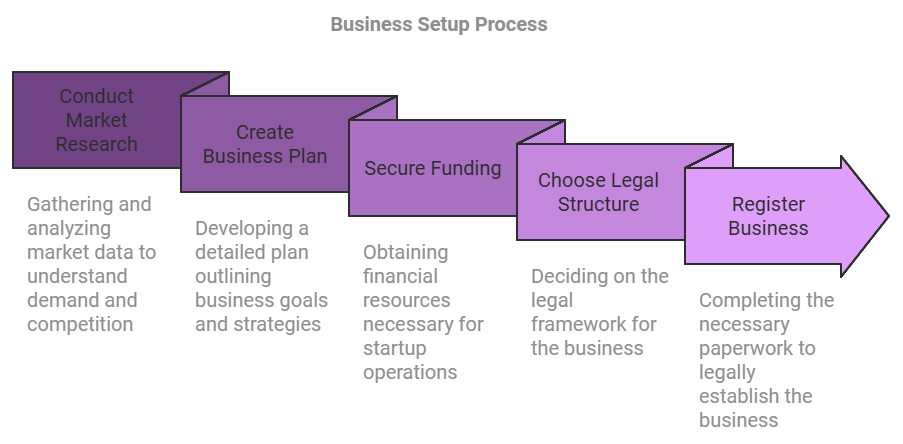

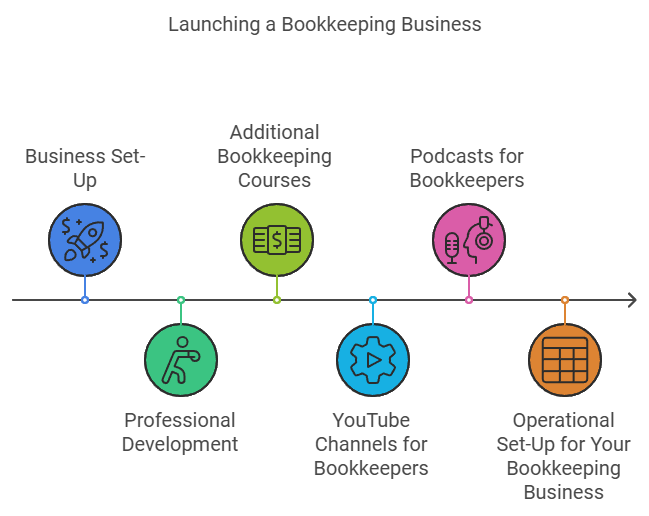

Setting up your bookkeeping business is an essential first step to establishing a solid foundation for success. Here’s a breakdown of the key elements to consider:

If you’re looking to start or grow your bookkeeping business, getting the right education is essential. Whether you’re new to bookkeeping or want to advance your skills, there are numerous resources and courses available to help you gain the expertise needed to succeed in this field. Below are some recommended resources for starting and advancing your bookkeeping career.

QuickBooks Online is one of the most widely used bookkeeping tools, and becoming a certified QuickBooks Online ProAdvisor can significantly boost your credibility. The QuickBooks ProAdvisor Program, offered by Intuit, is a free training and certification program that helps you master the software. It includes various modules covering topics such as setting up client accounts, managing finances, running reports, and reconciling accounts. Once certified, you’ll also gain access to marketing materials and the ProAdvisor directory, which helps potential clients find you.

Bookkeeper Launch is an online course and training program designed for individuals who want to start and grow their own bookkeeping business. Created by CPA Ben Robinson, this course covers both the technical bookkeeping skills and business-building strategies needed to succeed as a freelance bookkeeper.

There are several other platforms that offer excellent bookkeeping courses:

In addition to formal courses, YouTube offers free educational content on bookkeeping.

Podcasts are another fantastic way to continue learning and stay inspired while running your bookkeeping business. Here are some of the most popular podcasts for bookkeepers:

Building a strong brand and networking with the right people are crucial steps to growing your bookkeeping business. Here’s how to get started:

1. Develop Your Brand

Start by creating a logo and a professional website. A well-designed website is more than just a digital presence—it’s your brand. Your website is often the first impression potential clients will have of your business, so it’s important that it reflects your expertise and professionalism. A strong website can showcase your services, highlight client testimonials, and position you as a knowledgeable and reliable bookkeeping professional. An effective, polished website can help you attract more clients by conveying trust and professionalism.

Click here to get a professional website that attracts clients.

2. Build an Online Presence

Establish profiles on key social media platforms, such as LinkedIn, Facebook, and Instagram. These platforms allow you to connect with potential clients, share insights, and showcase your expertise in real-time. Regular posting and interaction help build credibility, keep your brand visible, and provide clients with easy ways to reach you.

3. Network with Other Professionals

Networking is essential for gaining referrals and expanding your reach. Join Facebook groups and LinkedIn communities where business owners and bookkeepers connect. By contributing helpful insights and engaging with other professionals, you can build valuable relationships that might lead to referrals or collaborations. Networking also keeps you informed about industry trends and challenges, making you a more informed and capable bookkeeper.

4. Content Marketing

Attract potential clients by sharing your knowledge through various forms of content marketing. Start a blog on your website to post bookkeeping tips, create e-books on specialized topics, host webinars, or launch a podcast to engage your audience directly. Each of these content types offers a chance to showcase your expertise and help clients understand the value of bookkeeping. By consistently providing valuable information, you position yourself as a trusted expert, drawing in clients who value informed and reliable bookkeeping services.

Setting up efficient operations is essential for running a successful and scalable bookkeeping business. Here’s how to get your operations in place:

1. Choose Software

Selecting the right bookkeeping software is foundational to your workflow. Options like QuickBooks Online, Xero, and FreshBooks offer versatile tools for managing clients’ finances, tracking transactions, and generating reports. Your choice of software should align with your service offerings and client preferences, ensuring seamless and efficient financial management.

2. Develop Standard Operating Procedures (SOPs)

Establishing clear Standard Operating Procedures (SOPs) is key to delivering consistent and reliable services. Create detailed workflows for each step of your process, including client onboarding, service delivery, and regular client communication. SOPs will help you streamline operations, maintain quality, and ensure clients receive the same high standard of service every time.

3. Decide on Types of Services

Determine which services you’ll offer based on your skills and client needs. Common bookkeeping services include general bookkeeping, tax preparation, payroll, accounts payable/receivable (AP/AR), and financial reporting. Deciding on your service offerings upfront will help you set clear expectations and attract the right clients for your business.

4. Pricing

Choose a pricing model that reflects the value of your services and meets client needs. Options include hourly rates, fixed fees, or bundled packages. Bundled packages can simplify your offerings and provide clients with predictable costs, making it easier for them to choose the level of support that best suits their needs. Setting a clear pricing structure helps build transparency and trust with clients. Most bookkeeping businesses choose a fixed-rate pricing model over hourly rates. Fixed rates reflect the value of your services, provide clients with predictable costs, and simplify the decision-making process.

5. Identify Your Niche

Focusing on a specific niche can set you apart from competitors and make it easier to market your services. Consider industries where you have expertise or a strong interest, such as healthcare, real estate, e-commerce, or nonprofits. Serving a particular niche allows you to tailor your services to meet specific industry needs, positioning you as a specialist in that area.

Starting a bookkeeping business offers numerous benefits: low startup costs, flexibility to set your own hours, a steady demand for services, and the potential for recurring revenue. It’s a career path that allows you to work independently, scale as you grow, and make a meaningful impact by helping businesses manage their finances effectively.

Now, over to you—take the first steps toward building a successful bookkeeping business and enjoy the rewards of being your own boss.