Engagement letters are key documents that set the stage for our relationships with clients. Whether you’re writing one for accounting, bookkeeping, or as a CPA, they’re essential.

These letters ensure everyone understands what’s expected and build trust between us and our clients. We’ll cover everything from following rules to making sure things are easy to understand.

So, whether you’re an experienced CPA or a bookkeeper, stick with us as we make these documents clear and effective. Ready to get started? Let’s dive in!

Today, we’re talking about something really important in the accounting world: engagement letters.

Engagement letters are key documents that set the stage for our relationships with clients. Whether you’re writing one for accounting, bookkeeping, or as a CPA, they’re essential.

These letters ensure everyone understands what’s expected and build trust between us and our clients. We’ll cover everything from following rules to making sure things are easy to understand.

So, whether you’re an experienced CPA or a bookkeeper, stick with us as we make these documents clear and effective. Ready to get started? Let’s dive in!

When you enter the world of accounting, whether you’re a CPA, a bookkeeper, or just starting out, one term you’ll hear a lot is “accounting engagement letter” or “bookkeeping engagement letter.”

But what exactly is an accounting engagement letter, and why is it so important for both you and your clients?

Let’s break it down into simple, everyday language, making it easy to understand:

Think of an engagement letter as a promise between you and your client. It’s a document that outlines what you’re going to do, how you’re going to do it, and what both parties can expect from each other.

Accounting Engagement Letter Should Include:

In essence, an accounting engagement letter, whether for bookkeeping, CPA services, or general accounting, serves as the foundation of the professional relationship.

It ensures clarity, sets expectations, and legally protects both parties. So, before diving into the financial nitty-gritty with your clients, make sure this crucial document is in place.

In the fast-paced world of accounting, engagement letters play a vital role in making operations run smoothly. But why are they so essential for accountants and their firms?

Let’s dive in, using simple language and bullet points to keep things clear:

Engagement letters serve as your map, outlining the services you’ll provide. This clarity helps avoid any confusion or miscommunication later on.

An engagement letter protects you and your client by clearly stating the terms of your agreement. If disputes arise, this document can be a lifesaver, offering evidence of what was agreed upon.

Using engagement letters shows your clients that you mean business. It’s a sign of professionalism and helps to establish trust. It’s like dressing up for a job interview; it sets the right tone from the start.

These letters help manage everyone’s expectations. By clearly stating what you will and won’t do, there’s less room for misunderstandings. Think of it as setting the rules of a game before you start playing.

Engagement letters lay out the payment terms upfront, reducing the chance of future disputes.

Sometimes, clients might ask for more than what was initially agreed upon. An engagement letter defines the scope of work, helping to prevent “scope creep.” This ensures you’re compensated for any extra work.

In summary, engagement letters are not just a formality; they’re an essential tool in the accounting world.

They provide clarity, protection, and professionalism, ensuring both you and your clients are on the same page from the get-go. So, before diving into your next accounting project, remember to draft that engagement letter.

It’s a small step that can save a lot of time and trouble later on.

When it comes to bookkeeping, clear communication with your clients is key. That’s where a bookkeeping engagement letter(proposal) comes into play.

Think of it as a friendly handshake in written form, one that sets the stage for your professional relationship.

Here’s how to create one that covers all the essentials, in a way that’s easy for everyone to understand:

Simply state that the letter outlines the bookkeeping services you’ll provide, ensuring everyone is on the same page.

Imagine you’re writing a grocery list. Each item represents a service you offer, such as managing general ledgers, preparing financial statements, or handling payroll. Be clear and concise to avoid confusion later.

Talk about money openly. Mention how you charge, whether it’s a flat fee or hourly rate, and when you expect to be paid.

It tells you when things will happen. Include when the work starts and ends and any important deadlines. This helps everyone know what’s going on and when.

Reassure your clients that their financial information is safe with you.

Make it clear what you need from your client. Maybe you need access to their financial records or timely responses to questions.

Briefly mention how either party can end the agreement if things don’t work out. It’s a safety net, ensuring that everyone knows there’s a respectful way to part ways if necessary.

By including these elements in your bookkeeping engagement letter, you’re not just drafting a document; you’re building a foundation for a successful and transparent working relationship.

Remember, the goal is to make everything clear and straightforward, setting the stage for a smooth collaboration.

In today’s fast-paced world, creating the perfect engagement letter for accounting, bookkeeping, or CPA services doesn’t have to be a headache.

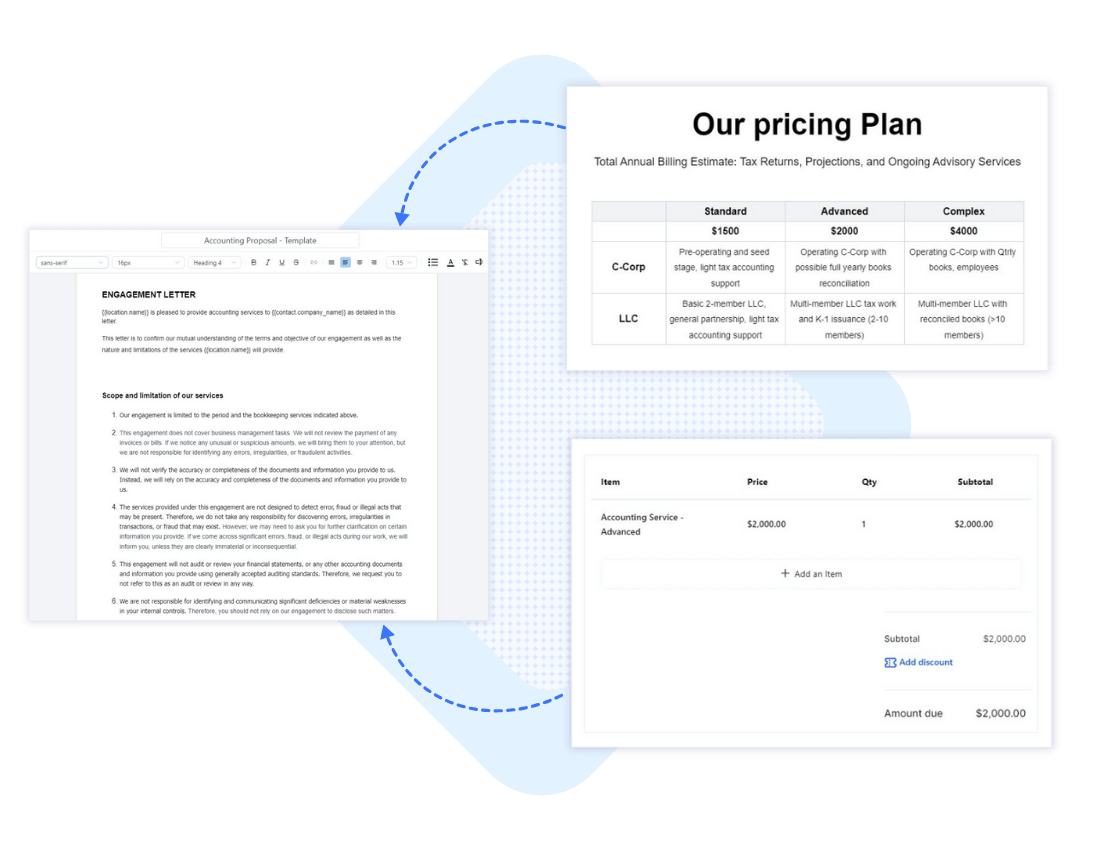

Enter Daybooks Accounting Engagement Letter & Proposal Software, your go-to solution.

Let’s break down how this software simplifies the process, making it as easy as pie:

Imagine having a template for almost every scenario – that’s what Daybooks offers. Whether you need an accounting engagement letter, a bookkeeping engagement letter, a CPA engagement letter, or general engagement letters for accounting, there’s a template ready for you.

With Daybooks, you can tweak these templates to fit your exact needs. Add your services, fees, and terms without starting from scratch.

This software is a real time-saver. No more hours spent drafting and formatting letters. It’s like using a fast-forward button on your tasks, giving you more time to focus on what you do best – helping your clients.

Daybooks help you maintain a professional look with consistent formatting. Every letter you send will look polished and professional, just like if you had a personal stylist for your documents.

You don’t need to be a tech wizard to use Daybooks. It’s designed with simplicity in mind, so you can start creating engagement letters right away. It’s as user-friendly as your favorite smartphone app.

Incorporating Daybooks into your practice means you’re not just keeping up with the times; you’re setting yourself apart by easily delivering high-quality, professional engagement letters. It’s a small change that can make a big difference in how you manage your client engagements.

Accountants, listen up! Using software designed just for accounting proposals can really make your life easier. It’s like having a magic wand that:

Plus, saving money and resources with this software means more funds for things that matter to your firm. So, jumping on the proposal software train could be a big win for your accounting business. Get ready to see some serious growth and success!